Biweekly pay calculator georgia

Just in case you need a simple salary calculator that works out to be approximately 2270 an hour. This calculator shows you possible savings by using an accelerated biweekly mortgage payment.

Georgia Paycheck Calculator Smartasset

This simple technique can shave years off.

. Switch to Georgia salary calculator. For 2022 the minimum wage in Georgia is 725 per hour. Georgia Salary Paycheck Calculator.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. If you are paid every other week then multiply the 40 by 2 get 80. Adjustments are made for holiday and vacation days.

This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. Although it is called a Salary Calculator wage-earners may still use the calculator to convert amounts. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Switch to Georgia hourly calculator. It determines the amount of gross wages before taxes and deductions that.

Biweekly pay 48 weeks. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. For example if you work 8 hours a day 5 days a week that is 40 hours per week.

So the tax year 2022 will start from July 01 2021 to June 30 2022. If you work 50 weeks a year are paid ever other week then. If you make 55000 a year living in the region of Georgia USA you will be taxed 11755.

000 biweekly 000 hour GS-1 is equivalent to the rank of Private in the US. Less printing andor posting cost. Paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year.

Georgia has their minimum wage rate set at 515 but the 7. Ad Payroll So Easy You Can Set It Up Run It Yourself. As of Aug 28 2022 the average annual pay for a Biweekly in Georgia is 47211 a year.

There are 52 weeks per year. The frequency of your paychecks will affect their size. This is the equivalent of 907week or 3934month.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Georgia Hourly Paycheck Calculator. So if you make 2000 every other week divide that amout by 80 and you would.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Important note on the salary paycheck calculator. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

Biweekly pay 52 weeks. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Our 2022 GS Pay Calculator allows you to calculate the exact salary of any General Schedule employee by choosing the area in which you work your GS Grade and your GS Step.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. All Services Backed by Tax Guarantee. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Many employees claim they would prefer to get paid every week. If you have 2 unpaid weeks off you would take off 1 biweekly pay period.

Workers compensation insurance is required when a company has at least three employees including part-time workers. The calculator on this page is. If all time off is paid you would multiply your biweekly pay by 26 to convert it to the equivalent annual salary.

That means that your net pay will be 43245 per year or 3604 per month. After 27 weeks at Step 1. Divide weeks by 2 in order to covert them into biweekly pay periods.

Biweekly pay 50 weeks. Less work for the payroll department. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State Income Tax Rates and Thresholds in 2022. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235. Calculate FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income.

Employers have to pay a matching 145 of Medicare tax but only the employee is responsible for paying the 09 Additional Medicare Tax. Use this Georgia gross pay calculator to gross up wages based on net pay. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax.

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks. 26 paychecks instead of 52.

Divide your biweekly income by how many hours you typically work in a your typical pay period. Your average tax rate is 214 and your marginal tax rate is 354. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator.

Details of the personal income tax rates used in the 2022 Georgia State Calculator are published below the calculator. Bi-weekly pay is the preferred pay method by Employers.

Georgia Tax Tables Georgia State Withholding 2021

Free Printable Savings Challenge Rainy Day Fund In 2022 Tracker Free Money Saving Strategies Rainy Day Fund

Georgia Paycheck Calculator Tax Year 2022

Employee Self Service Human Resources

How To Make A Checkbook Register In Excel Download This Financial Checkbook Register Excel Worksheet Templat Budgeting Worksheets Checkbook Register Checkbook

How To Calculate Child Support In Georgia 2018 How Much Payments

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

Cost Of Living Adjustment Human Resources

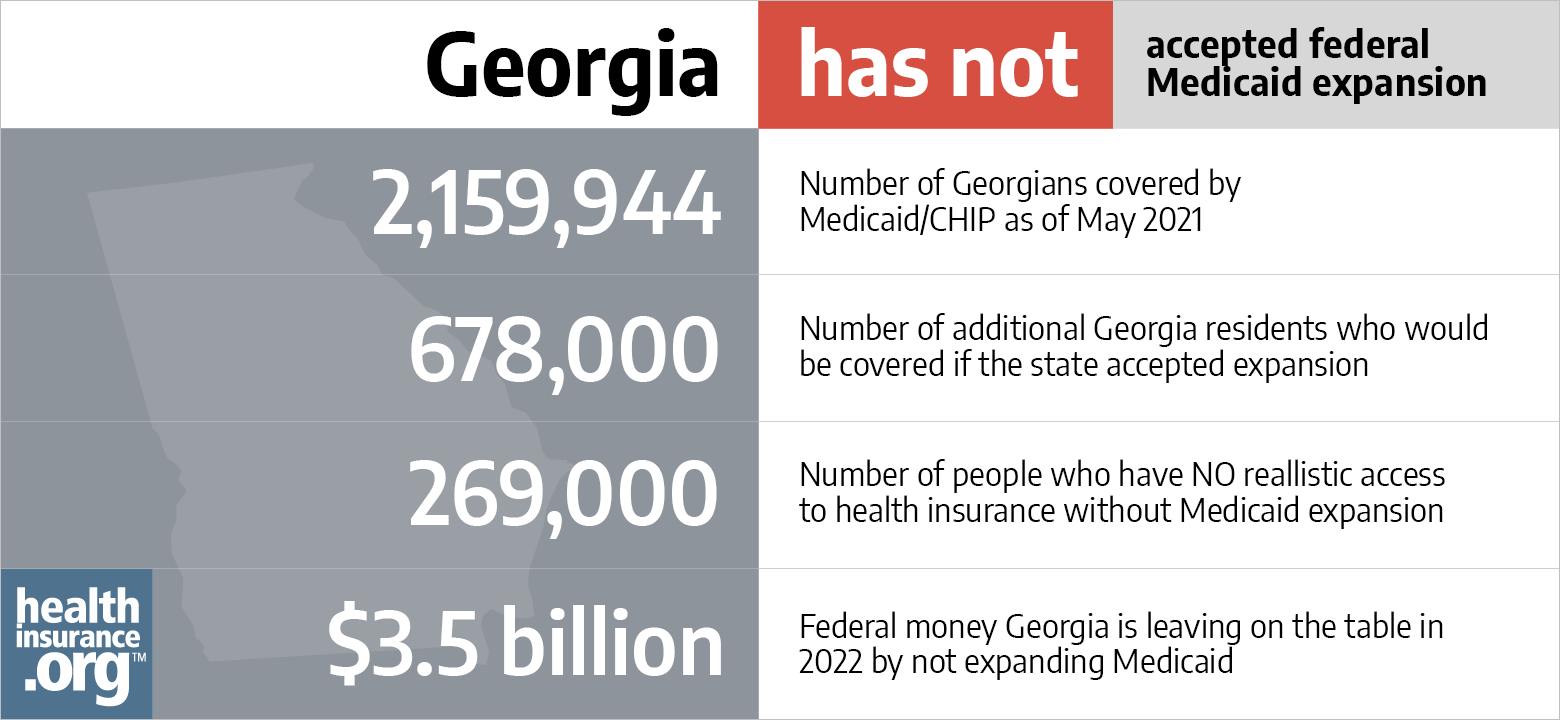

Aca Medicaid Expansion In Georgia Updated 2022 Guide Healthinsurance Org

Georgia Sales Reverse Sales Tax Calculator Dremploye

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

Calculator Salary In Atlanta Ga Comparably

Georgia Paycheck Calculator Smartasset

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Online Payday Loans In Georgia Short Term Loans With No Credit Check Compacom

Employee Self Service Human Resources

Paycheck Calculator Georgia Ga Hourly Salary